Asian Options

Also known as Average Options

This type of option has its payoff determined by the average price of the underlying over a defined period of time.

These options are path dependent

The settled amount is the difference between the strike price and the average price over a defined period.

This average can be a geometric average or an arithmetric average.

One advantage is that they reduce the risk of market manipulation of the underlying asset at maturity.

take the price of the stock after each 20 day period

price after 20 days - £21

price after 40 days - £22

price after 60 days - £24

(all these prices are then averaged)

profit = average price - strike price

if profit < 0, it wont exercise and you lose the premium

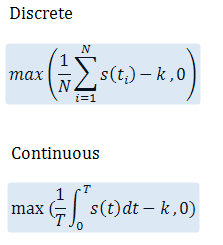

Payoff Equation

|

How to Price

Variance Gamma model can be efficiently implemented when pricing these options.

© 2025 Better Solutions Limited. All Rights Reserved. © 2025 Better Solutions Limited TopPrevNext